Seamless Transactions: Mastering Payment Gateway Integration

The seamless integration of gateways for payment is the cornerstone which enables businesses to engage in safe and efficient transactions in the present-day digital world, where e-commerce and online payments have grown to be routine. The technological connection that exists between your e-commerce site and the banking system which enables the collection and processing of transactions from customers all over the world is known as payment gateway integration. Among the myriad of payment gateway options available, two prominent players, Stripe and PayPal, have carved out their niches. In this exploration of payment gateway integration, we will delve into the significance of these gateways and shed light on others as well. Join us as we embark on a journey through the world of online payments and uncover the key aspects of integrating these gateways to elevate your e-commerce ventures.

FACTORS TO BE CONSIDERED WHEN CHOOSING A PAYMENT GATEWAY

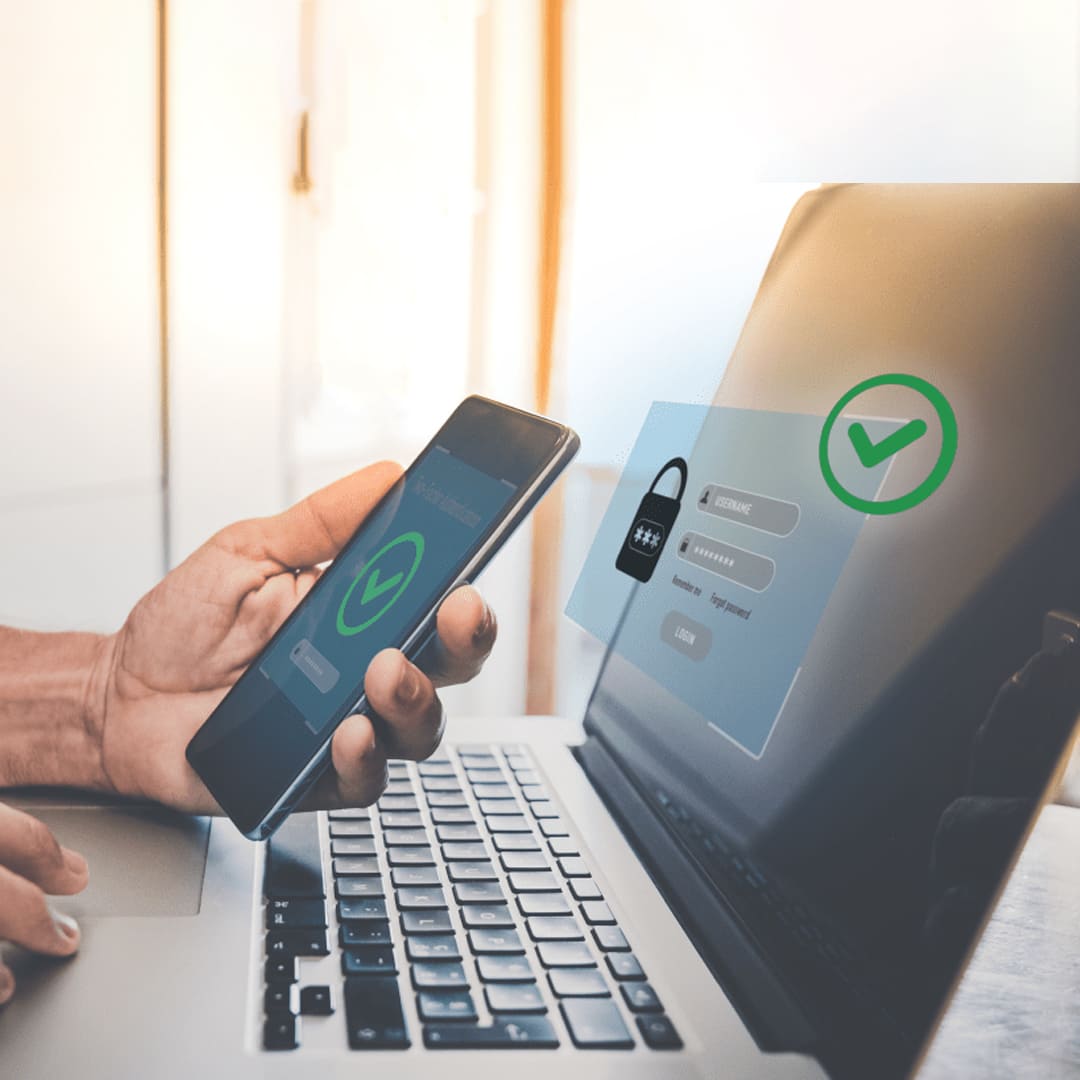

- Security and Compliance: Ensure the payment gateway is PCI DSS compliant to protect sensitive customer data. Look for features like tokenization and encryption to enhance security.

- Supported Payment Methods: Confirm that the gateway supports the payment methods your customers prefer, such as credit cards, debit cards, mobile wallets, and digital currencies.

- Geographic Coverage: Consider the gateway's availability in the regions where you operate or plan to expand. Some gateways may not support certain countries or currencies.

- Fees and Pricing Structure: Understand the fee structure, including setup fees, transaction fees, and monthly fees. Compare pricing to ensure it aligns with your business's transaction volume and revenue.

- Integration Options: Check if the gateway offers APIs, SDKs, or plugins for your e-commerce platform, website, or mobile app. Easy integration can save development time and resources.

- User Experience: Evaluate the checkout experience provided by the gateway. A smooth, user-friendly process can reduce cart abandonment rates.

- Mobile Compatibility: Ensure the payment gateway supports mobile devices, as an increasing number of customers shop on smartphones and tablets.

- Multi-Currency Support: If you operate internationally, consider a gateway that can handle multiple currencies and provide real-time currency conversion.

- Recurring Billing Support: If you offer subscription services, check if the gateway supports recurring payments and automated billing.

- Customer Support and Service Level Agreements (SLAs): since downtime or problems might be expensive, evaluate the standard of customer service and the availability of 24/7 assistance.

- Scalability: Select a payment gateway that will expand together with your company as it experiences growth in transaction volume and complexity.

Understanding Payment Gateways

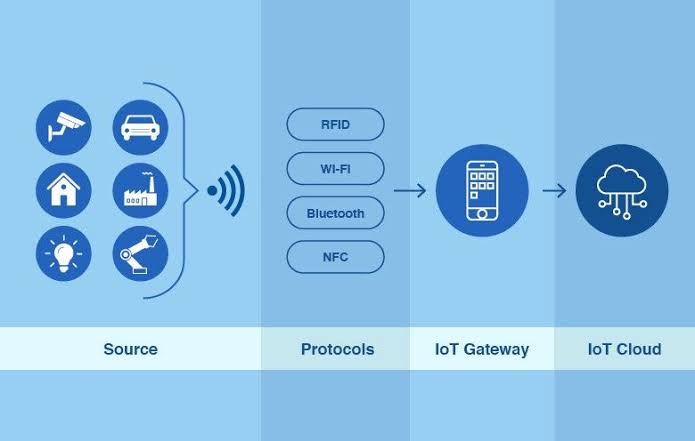

What Payment Gateways Do: Payment gateways are internet-based services designed to make a simpler process for customers to transfer payments to businesses. They function as an intermediary between the financial institutions that are managing the real transactions and your web page or app. Payment gateways are crucial for the profitable operation of your online business and safeguard the confidentiality of financial information that is sensitive.

Processor vs. Payment Gateway: It's important to keep in mind that payment processors as well as gateways are frequently misidentified for one another by consumers. Payment processing providers are responsible for the actual transfer of money between user accounts, whilst payment gateways oversee transaction authorization as well as data transmission. Payment gateways and processors are frequently merged into a single service.

Stripe: The Modern Payment Gateway

- Key Features of Stripe: a combination of its developer-friendly approach and feature-rich platform, Stripe has undergone enormous development. Flexibility for over 135 currencies, subscription management, and a simple API for customization are just some of Stripe's outstanding characteristics.

- Integration Steps with Stripe: Integrating Stripe into your website or app involves registering for an account, obtaining API keys, and embedding the necessary code. Stripe offers detailed documentation and SDKs for various programming languages, making integration relatively straightforward.

- Stripe's Competitive Edge: Stripe's strengths lie in its robust developer tools, extensive international reach, and flexible customization options. It is especially favoured by businesses looking to build custom payment solutions tailored to their specific needs.

Benefits of Stripe

- Organizations may simply incorporate Stripe into their websites and applications thanks to its developer-friendly APIs and extensive documentation.

- Multiple Payment Options: Stripe offers numerous payment options, such as credit cards, debit cards, digital wallets (like Apple Pay and Google Pay), and international payment methods, enabling businesses to serve customers worldwide.

- Global Reach: Stripe is perfect for companies with multinational clientele because it is accessible in several nations and supports multiple currencies.

- Security: Stripe is PCI DSS Level 1 certified and takes security very seriously. It includes strong security features like fraud protection measures and encryption.

- Recurring billing and subscription management are made simple for businesses by Stripe's built-in capabilities for managing subscription-based services.

- Customization: Companies can alter the Stripe payment procedure to better reflect their brand, resulting in a streamlined and unified customer experience.

- Reporting and Analytics: To assist businesses in keeping track of transactions, keeping tabs on income, and making data-driven choices, Stripe offers comprehensive reporting and analytics capabilities.

- Developer Resources: In addition to testing environments and libraries for different programming languages, Stripe also provides a variety of developer resources.

- Transparent Pricing: Stripe has transparent and competitive pricing with no setup fees or monthly fees.

Disadvantages of Stripe:

- Limited Chargeback Protection: Stripe's dispute resolution process may not always favour sellers, and chargebacks can lead to disputes and financial losses for businesses.

- Account Freezes: Like PayPal, Stripe may suspend or freeze accounts if they suspect fraudulent activity, which can be disruptive for businesses.

- Transaction costs: Although Stripe's costs are reasonable, they can still add up, especially for companies that process a lot of transactions.

- Customer service: Some users, particularly those who are smaller firms, have complained about problems with Stripe's customer service.

- Competition: Other payment processing platforms compete with Stripe and may provide various features and fee schedules.

- Refunds and Disputes: Dealing with refunds and disputes can be a little complicated, so firms need to be ready to handle these areas efficiently.

PayPal: The Trusted Payment Giant

Key Features of PayPal: Customers are able to utilize their personal favourite payment methods, such as credit cards and bank accounts, to make transactions via PayPal's safe and convenient online transactions without exposing their confidential financial information to businesses. It is a dependable and adaptable substitute for e-commerce transactions since it offers excellent safeguards against fraud as well as integration opportunities for businesses. For repeat clients, PayPal's One Touch feature streamlines the checkout procedure.

Integration Steps with PayPal: You must set up settings, create a business account, and include PayPal's SDK into your website or application in order to integrate PayPal. The straightforward integration process of PayPal makes it available to companies of all sizes.

Advantages of PayPal:

- Convenience: Without having to provide sensitive financial information, PayPal offers a straightforward way to pay money to individuals or organizations over the Internet.

- Widely acknowledged: Due to PayPal's widespread acceptance by online merchants and websites, it is a popular choice for online transactions and purchases.

- Security: To assist in protecting user accounts and transactions, PayPal uses strong security measures like fraud protection and encryption.

- Buyer Protection: PayPal has a program called "Buyer Protection" that entitles customers to reimbursements if they receive goods that are radically dissimilar from what was advertised or if they don't receive anything at all.

- Seller Protection: For qualified transactions, PayPal offers Seller Protection, assisting in defending sellers against specific kinds of bogus chargebacks or claims.

- Easy Integration: Businesses can easily integrate PayPal into their websites or e-commerce platforms using APIs, SDKs, or plugins.

- International Transactions: PayPal supports transactions in multiple currencies, making it suitable for international businesses and customers.

- Mobile Payments: PayPal's mobile app allows users to make payments and transfer money on the go, enhancing its accessibility.

Disadvantages of PayPal:

- PayPal charges fees for several sorts of transactions, such as currency conversion and accepting payments for goods and services, despite providing a free account option.

- Account Freezes: Some users have expressed displeasure that, due to security concerns, their accounts have been temporarily suspended or restricted, which can be irritating and unpleasant.

- Transaction delays: Bank withdrawals may take several days to complete, delaying the money's availability.

- Limited Seller Protection: Seller Protection has limitations, and sellers may not always be covered in cases of disputes or chargebacks.

- Currency Conversion Fees: PayPal's currency conversion fees can be high compared to other options, especially for international transactions.

- Customer Service Issues: Some users have had negative experiences with PayPal's customer service, citing difficulties in resolving account-related issues.

- PayPal collects and preserves information about users, which has prompted certain individuals to raise concerns regarding privacy.

- Despite the fact that PayPal is extensively used, it is up against rival payment services like Stripe, Square, and others that could have various functionality and cost structures.

Other Notable Payment Gateways

- Square: square is a flexible platform for managing payments and businesses of various kinds, from tiny retailers to bigger corporations. It has grown in popularity because of its simplicity of use, open pricing, and a variety of features that aid businesses in efficiently managing payments, inventories, and operations. Because of its ease of use, the square is an increasingly common option for businesses that are small or medium-sized. It gives companies a point of sale (POS) system that's compatible well with online businesses.

Features

- Solutions for Point of Sale (POS): Square provides a range of POS options, including hardware and software, that let companies take payments in-person, at events, and while they're on the go. This includes the Square Register and the Square Stand for iPads.

- Payment Methods: Square enables businesses to process various types of payments, such as contactless payments (like Apple Pay and Google Pay), credit and debit cards, magstripe cards and chip and PIN cards.

- Payments made online: Square provides businesses with the tools and resources they require for accepting payments made online through e-commerce websites or by developing branded payment links that can be disseminated via email or social media.

- Inventory management: Square gives businesses access to inventory management tools that let them monitor stock levels, get notifications when supplies are running short, and examine sales patterns.

- Analytics and Reporting: Square provides thorough reporting and analytics, enabling organizations to learn more about customer behaviour, sales data, and other topics.

- Customer Engagement: To interact with customers, businesses using Square can construct customer databases, send marketing campaigns, and implement loyalty programs.

- Authorize.Net: Numerous payment alternatives are available through Authorize.Net, which is well renowned for its strong security features. For companies that place a high priority on data security, it's a great option.

Features

- Authorize payments made in person. To process payments in physical locations, such as retail establishments or events, Net can be coupled with point-of-sale (POS) systems and portable card readers.

- Authorize.net PCI complies with stringent security regulations to safeguard sensitive payment data because it is PCI DSS (Payment Card Industry Data Security Standard) compliant.

- Advanced Fraud Detection: To assist organizations in lowering the risk of fraudulent transactions, the service offers user-customizable fraud prevention tools and filters.

- 24/7 Assistance: To help businesses with questions and problems relating to payment processing, Authorize.Net provides customer support around-the-clock.

- Various Currencies: Authorize.Net allows for currency-neutral transactions, making it suitable for businesses with a global customer.

- Braintree: Braintree, owned by PayPal, focuses on providing seamless mobile payment solutions. It offers easy integration and supports multiple currencies and payment methods.

Features

- Advanced Fraud Detection: To assist organizations in lowering the risk of fraudulent transactions, the service offers user-customizable fraud prevention tools and filters.

- Customization: To accommodate a company's branding and user interface requirements, developers can alter the payment experience.

- Braintree provides pre-built payment solutions that can be quickly integrated into websites and e-commerce platforms for companies without significant development resources.

- Braintree is appropriate for companies with a global clientele because it allows for currency conversions.

Choosing the Right Payment Gateway

- Factors to Consider: Factors to consider when selecting a payment gateway include transaction expenses, international assistance, integration simplicity, and excellent service for customers. It's essential that you choose a gateway that compliments the specific demands as well as the goals of the business you represent.

- Security and Compliance: Ensure that the payment gateway you choose complies with industry security standards like PCI DSS (Payment Card Industry Data Security Standard) to protect customer data.

Integration Best Practices

- User Experience: A smooth and intuitive checkout process is essential for customer satisfaction. To reduce friction during the purchasing process, payment gateways should be seamlessly incorporated into your website or application.

- Mobile Optimization: Considering the recent boom in mobile commerce, it's essential that you make sure the payment system you use is mobile-friendly, providing an effortless transaction on smartphones and tablets.

- A/B testing: Conduct A/B tests on an ongoing schedule in order to monitor and enhance the effectiveness of your payment gateway and to identify and address whatever issues that may be harming your rate of conversion.

- Meeting Customer Expectations: In today's competitive online marketplace, providing a secure and seamless payment experience is paramount. Customers expect hassle-free transactions, and choosing the right payment gateway is a crucial step in meeting those expectations.

- Staying Competitive: As technology evolves and customer preferences change, businesses must adapt and stay current with payment gateway options and integration practices. By doing so, they can remain competitive and offer a superior shopping experience to their customers.

In the dynamic world of e-commerce, payment gateway integration stands as the digital conduit between businesses and their customers, enabling secure and seamless transactions. While Stripe and PayPal have emerged as leaders, numerous other gateways cater to diverse needs. As we conclude our exploration of payment gateway integration, it becomes clear that adaptability is key in this realm. Businesses must choose gateways that align with their specific requirements and stay attuned to evolving customer preferences and emerging technologies. By mastering the art of payment gateway integration, businesses can not only secure their transactions but also foster trust, convenience, and satisfaction among their customers, thereby propelling their e-commerce ventures to new heights in the ever-evolving digital marketplace.

Recent Stories

500k Customer Have

Build a stunning site today.

We help our clients succeed by creating brand identities.

Get a Quote